I want to revisit a huge issue that is often overlooked with Monte Carlo scenarios. Remember, Monte Carlo’s provide a probability of success around three inputs, return expectations, volatility around those return expectations and inflation. The problem here is that while the standard deviations used tell us the ups and downs of investment returns, we’re using a fixed inflation rate. This is hugely problematic because there is never a fixed inflation rate.

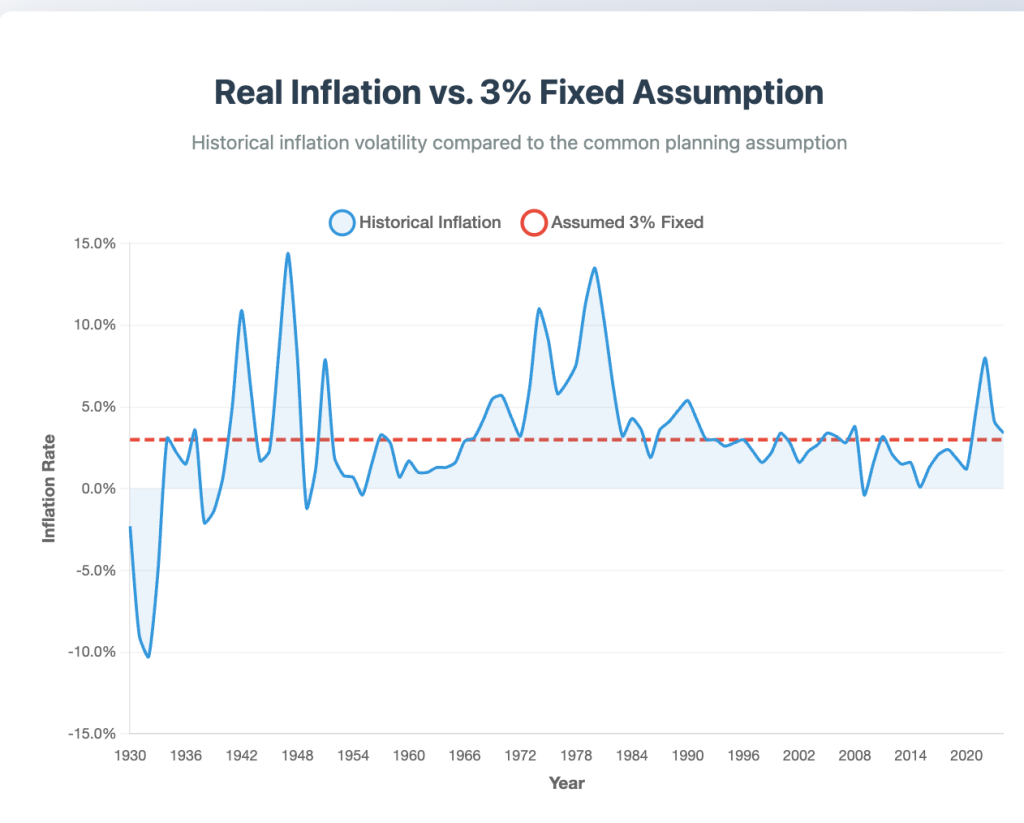

Look at this image:

The blue line is the actual annual inflation rate going back to 1930. Notice it bounces all over the place. The red is an assumed average inflation rate, in this case 3.0% which isn’t all that far off from the actual inflation rate of 3.2% over that time. Because these two numbers are so close many people won’t see the issue, which is that in most years the real inflation rate was nowhere near the assumed 3%.

The Real-World Impact

Let’s look at two retirement scenarios to see how bad this mismatch can get.

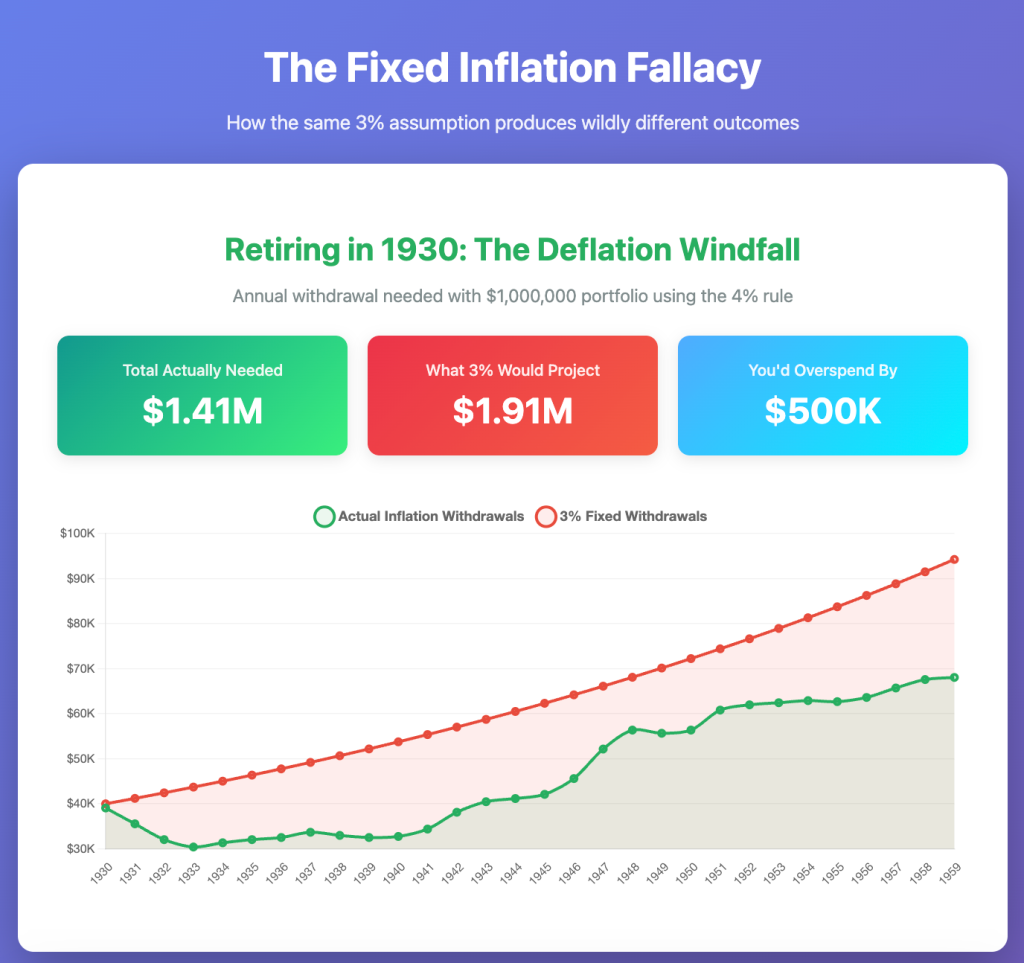

Scenario 1: The 1930 Retiree (Good Luck)

Someone retiring in 1930 who assumed 3% annual inflation would have withdrawn about $500,000 more from their portfolio over 30 years than they actually needed to maintain their purchasing power. Why? Because actual inflation during those years (including the Great Depression’s deflation) was much lower than 3%.

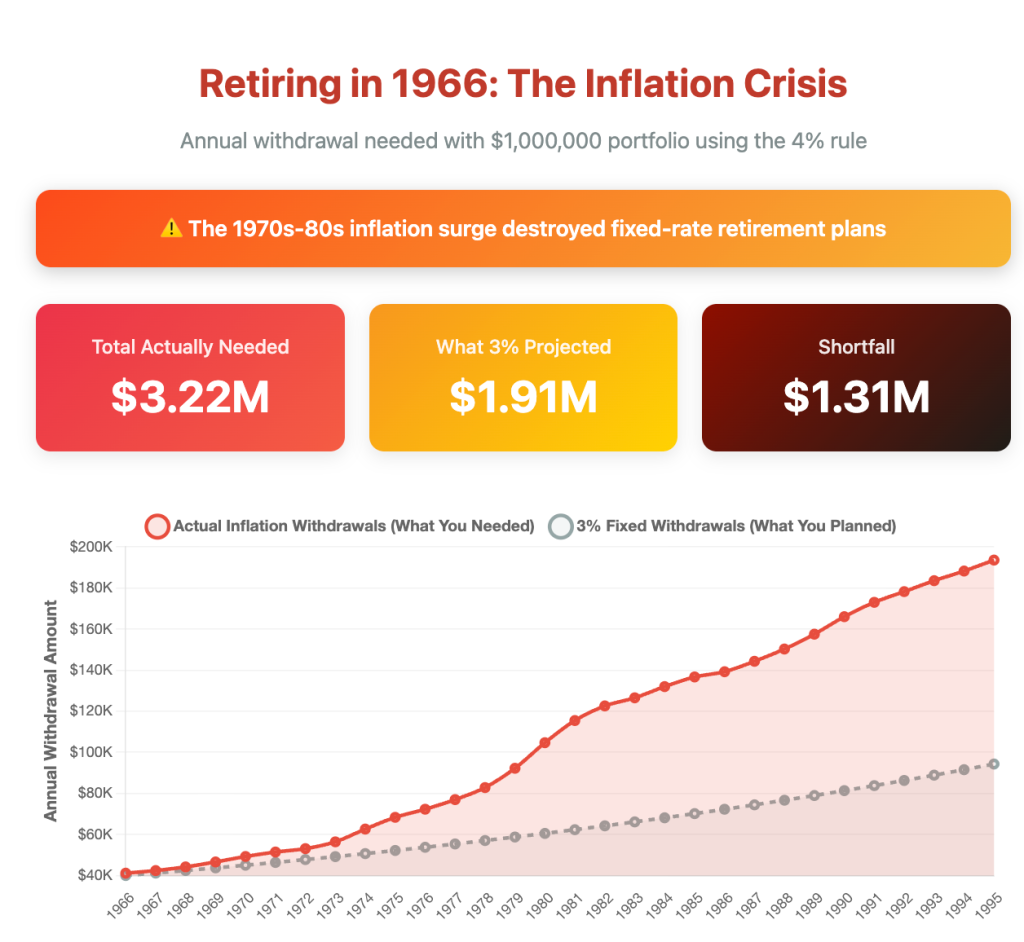

Scenario 2: The 1966 Retiree (Disaster)

Someone retiring in 1966 with that same 3% assumption would have come up $1.3 million short. The 1970s inflation crisis meant they needed far more money than planned to cover their actual expenses.

Why Don’t Simulations Fix This?

It’s bizarre: retirement software accounts for investment volatility but ignores inflation volatility, even though both stem from the same changing economic conditions.

Think about it: In 2008’s Great Recession, we had deflation, something we hadn’t seen in decades. In 2022, after COVID stimulus and supply chain chaos, we saw inflation rates also not seen in decades. Assuming a steady 3% for both scenarios makes no sense.

What Can You Do?

Using actual historical inflation patterns—with all their real-world variation—may give you better retirement projections than Monte Carlo simulations with fixed inflation assumptions.

See my video on this here. https://youtu.be/38Yy23nQmic?si=HT8Q3H_dLSFzdwad