Have You Seen This Video?

This is where I break down the benefit of the Trump proposal to end taxes on Social Security. In an odd turn of events, many of my fellow travelers on the right for some reason think this is a bad plan. I don’t get it. I thought right-wingers always wanted tax reductions…always and everywhere. Well, apparently not when it comes to allowing Social Security recipients to keep more of their money. Then it’s “we can’t do this or else it’ll further harm the system which is already in dire straits!”

As one guy commented:

Indeed, For instance, the Department of Defense doesn’t pay tax. And yet, no one ever says it’s going to run out of money. Do the people within the DOD pay tax? Of course. Are their taxes enough to cover the CURRENT deficits though? Not even close.

Other than a 4 year period with a GOP Congress and ole Slick Willie in the White House, the Federal Government has been running deficits for as long as I’ve been on this earth, 54 years. What do deficits do? They add on to the current debt.

Thus every year we go deeper and deeper into debt and people scream bloody murder that the debt will catch up to us some time. But when it comes to one’s favored program, say NASA, the EPA, war in Ukraine, etc., those programs always get “fully funded.” I mean, if we didn’t fund NASA we’d have no JWST which is SO KEWL…amirite? Just look at those purty pictures!

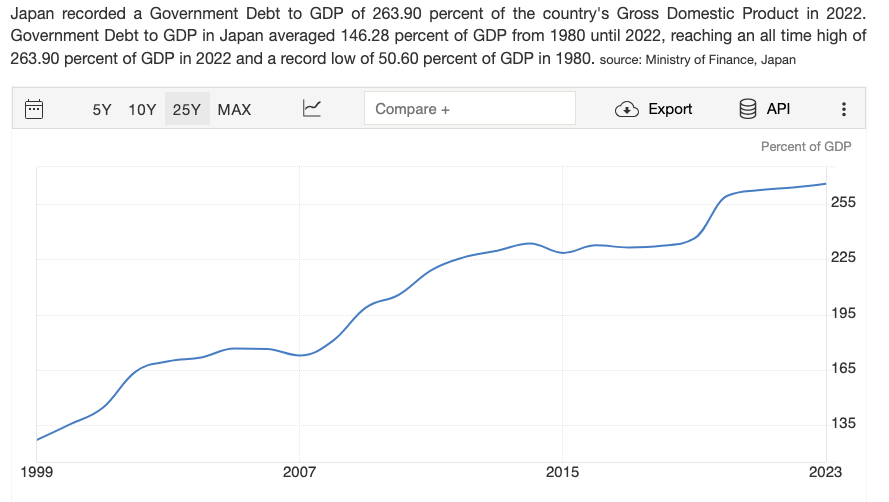

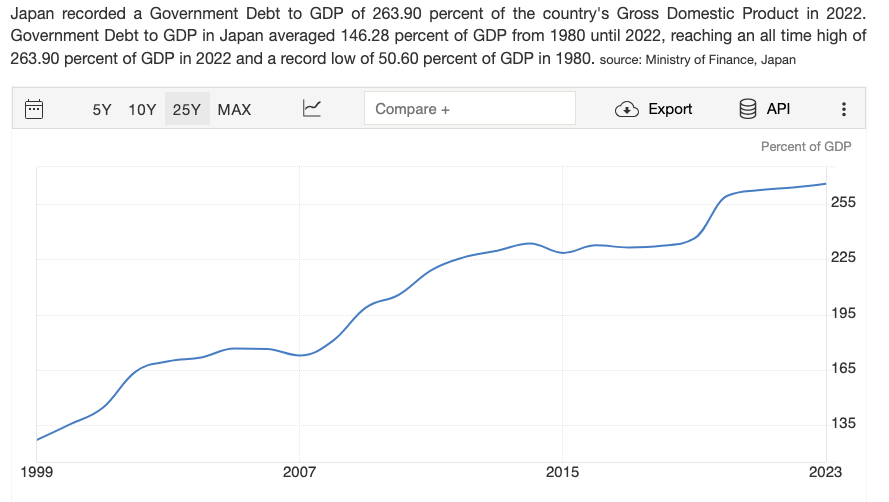

So we just keep on trotting along, paying the bills with an increasing larger debt. How long can it last? No one knows. Oddly enough Japan seems to still be going strong. In fact, the Yen just has a huge movement to the upside.

How can that possibly happen given Japan’s Debt to GDP ratio has been well above 200% for the past 10 years???

And yet, here we are. Somehow, Japan just keeps going further and further into debt and yet, oddly enough, inflation is minimal. Growth rate isn’t anything to write home about but welcome to the club. Look at all modernized economies. None of ’em have “high” growth rates.

Even weirder than…JD Vance? He’s the “weird” one? Uh huh. If you look at Germany with its Debt to GDP ratio of only 68% it’s the worst growing economy of all the big guys. In fact, last quarter it had NEGATIVE growth! Japan is smoking Germany on a growth rate perspective.

Weird, huh?

What does all this mean? Who knows? But when I hear people chastise us who want no tax on Social Security because it will somehow hurt the program…or Heaven forbid, the entire economy, I just laugh.

“But Josh, Social Security was never supposed to be funded with General Revenues.” Yeah, and men were supposed to be men…if you know what I mean. Things change.

I care a helluva lot more about Mr. and Mrs. Smith’s ability to get an extra couple hundred bucks in retirement than I do about our ability to promote DEI in government agencies. As far as the Tax Foundation saying there won’t be much of a benefit overall, I don’t care about overall. I care about Mr. and Mrs. Smith. They CAN benefit from paying no tax on their Social Security income.

It’s kind of like a Roth IRA. The overall benefit is probably not great and, in fact from a revenue perspective, hurts the Federal Government…well here’s a dime, go call someone who cares. (You young uns won’t get the reference). I’ll worry about the Federal Government’s revenues when we have evidence that those revenues are needed to continue to fund our vast empire of spending.

What I care about is, again, Mr. and Mrs. Smith’s ability to have a retirement plan that works for them. Paying less tax inherently makes the Smith’s retirement better. And YOU can benefit too. These are not discriminatory benefits. You just have to know how they work. |