Here’s something that might surprise you: a portfolio that bounces up and down can actually be better for retirement than one that stays perfectly stable. Yes, even those scary down years can work in your favor.

The Unexpected Power of Volatility

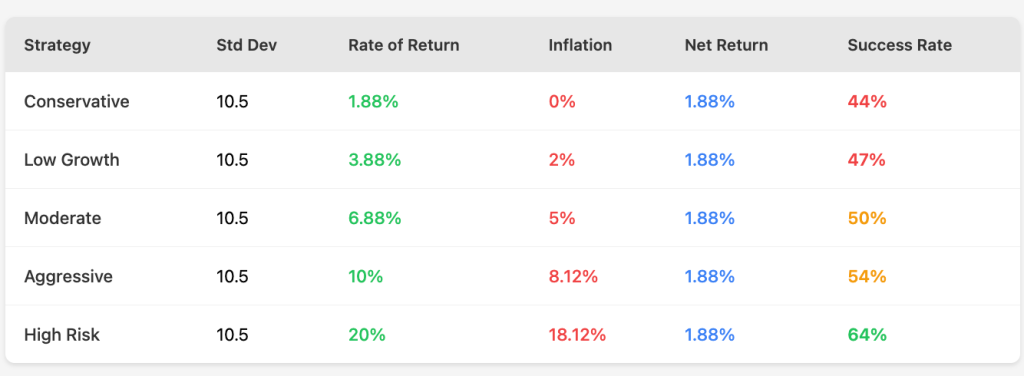

Let’s look at a real example. The worst twenty-five year period for a 50% US large cap stocks, 25% US Bonds and 25% cash portfolio was 1957-1981 when it earned 6.90% but inflation ate up 5.02% of that. Your real gain after inflation? Just 1.88%.

Here’s where it gets interesting. When your net return stays at 1.88%, using the same standard deviation, your chances of retirement success actually improve when both returns and inflation are higher.

Why? It comes down to the range of possible outcomes. With high returns, high inflation and a 10.5% standard deviation your portfolio might swing from -11.5% to +51.5% in any given year. Yet with low returns and low inflation, those same swings go from -29.62% to +33.38%. Same net result, but notice how the high-inflation scenario protects you better on the downside while giving you more upside potential.

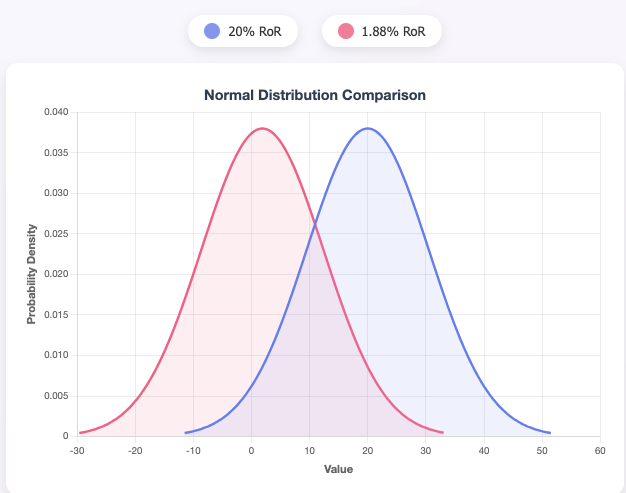

The graph below compares two portfolios having the same 1.88% net rate of return and the same 10.5% standard deviation. The only difference is that one has a rate of return of 20% with an inflation rate of 18.12% while the other has a rate of return 1.88% with no inflation.

The reason for this is because the standard deviation is five times higher than the low return portfolio and yet only half as much as the high return portfolio. If you had to choose between the two portfolios with the same standard deviation always choose the one with the higher rate of return.

The Risk-Reward Tradeoff

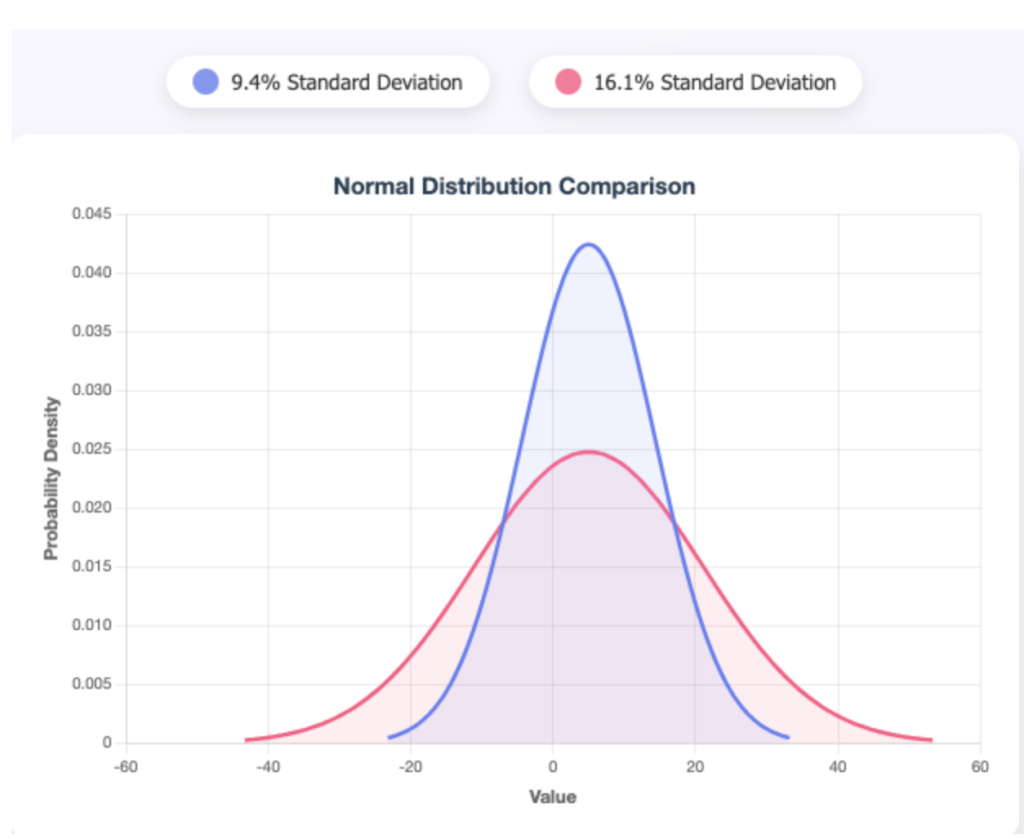

What if standard deviations are different but rates of return are the same? Take two $1 million portfolios, both with an average rate of return of 5%. In the chart below, the “low risk” column is a portfolio with a 9.4% standard deviation. The “high risk” has a standard deviation of 16.1%.

As you can clearly see, the range of results is much higher in the higher risk portfolio than it is in the lower risk portfolio. The next chart shows this.

The lower standard deviation portfolio has a narrower range whereas the higher standard deviation is wider. But remember, the market is historically positively skewed, meaning it goes up more than down. If this weren’t the case few people would invest as it would be considered speculation, i.e., gambling, in which the house wins more than loses. Investing though is different in that investors win way more than they lose, so long as they don’t jump ship when markets fall. Thus, you have to be careful being too risk averse as you’d be sacrificing potential growth for lower volatility, especially for a longer retirement period. Remember even as a retiree you’re most likely still a long term investor!

The Bottom Line

Don’t fear market volatility—understand it. A little fluctuation, combined with smart withdrawal strategies, can make your retirement more secure than you might think.