Man, I don’t know about you but I’m feeling a major decline in the economy. Hearing from folks all over who got laid off and weren’t expecting it.

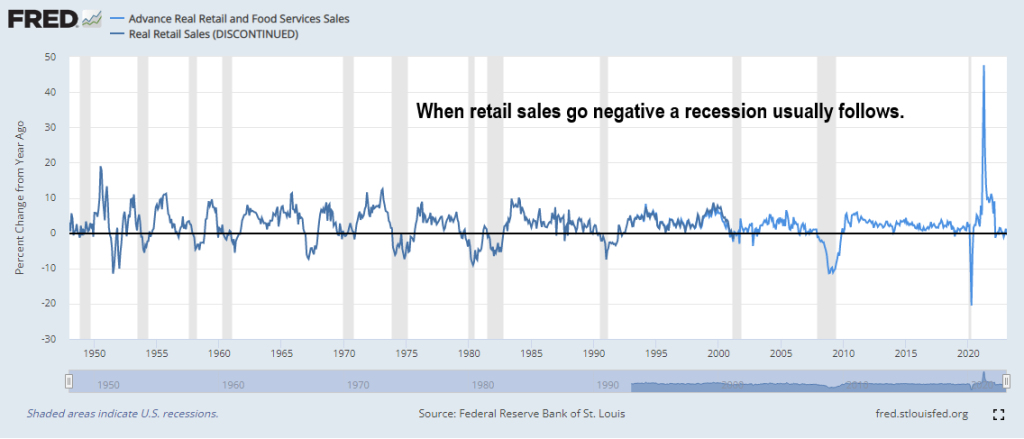

You can see it too in the Personal Consumption Expenditures the Fed reports. It’s in the NEGATIVE category now, which is typically indicative of a soft, if not, downright recessionary economy.

Maybe this doesn’t impact you. That’s great! But I still think there’ll be some info of value in this email.

First off, remember I am self-employed. So, while I can’t lay myself off I can certainly be laid off by people not using my services, not watching my videos, not buying my books etc. So let me share with you what I’m doing in preparation for a hard economic landing, which I fully believe is coming. (You can’t raise rates that much, that fast, without some negative results. And yes, while I don’t think the Fed is nearly in control of the economy as many, a sudden increase in interest rates does have an impact, for sure.)

So, say your income stops coming in. Guess what amigos, you still have bills to pay. Where does that money come to pay the bills? Cash. You are now being rewarded for having cash. Last I checked my Schwab money market account was paying something like 4.5%.

How much cash should you have? Well, enough to cover your expenditures until the income spigot turns on again. The question you’re going to need to answer is “how long will that take?”

Be honest here. 3 months? 6 months? A year? I don’t know. But I’d err on the side of caution. There won’t be a massive bailout like what happened in 2020 to get cash in people’s hands which means you’ll need more time to get your cash flow turned back on.

Where does the cash come from? Well, if you’re fully invested, as I WAS, with no cash liquidity, you’re going to need to think this through. Am I comfortable taking the risk of using my investment holdings to cover my expenses while I search for new income?

After 2007-2009, I said “never again.” I’ve talked many times how when the bottom fell out in the Great Recession it fell out everywhere and all at once. 57% declines in stocks. Huge real estate losses. Banks reneging on previously established Home Equity Lines. Credit card interest rates increasing to 18% even though, well for me, I thought I had 0% fixed for the life of the loan. What a fool I was for not reading the small print.

Oh, and don’t forget, finding work back then wasn’t easy for many people either.

In preparation for the slow down, I’ve parked a decent chunk of my portfolio into the money market to make sure IF things go south, I have a resource to cover me that won’t be down 57%. In 2007, I thought I could take the risk of leaving everything in equities. In 2009, I realized I couldn’t. A lesson I learned much too late.

Things are different now, of course. I have tons of equity in my home. More investable assets too and very little consumer debt. But guess what?

Our spending has increased relative to our income. Obviously, if things go south, we’d cut back big time. We’re already starting to do this in preparation. But man, you get used to a certain lifestyle and it’s not easy going away from that. But you’re going to have to realize you may need to tighten. Again, we’re doing that now, just to be prepared.

Now I’m not all in cash. I do have some individual stocks and a big position in a Federal Home Loan bank bond with a 6% coupon. I’ll also add some more equities to my portfolio shortly but I’m heavier than I’ve ever been in cash. Getting 4.5% makes it a whole lot easier to be in cash though, I have to say.

What if you though need to draw down your retirement portfolio to fund your expenses while waiting for your income to pick back up? Is that retirement-killer?

NOOOOOO!!! Hear me out. Let’s say you’re married and your Social Security benefit at Full Retirement Age is $3000. Your spouse stayed home to raise the kiddos so her (how dare I assume it’s a woman, amirite?) benefit is going to half of yours.

At FRA (67 for most of us), you’ll get $4500 a month in Social Security. That’s $54,000 a year, in today’s numbers. That’s not going to be enough in retirement you say. You sure about that? Don’t tell these people. Their spending is WAY lower than what you’d think and yet the vast majority are reporting they’re content in retirement. In fact, as I say in that video, they are increasing their non-discretionary spending on things like charitable giving and travel. Can’t do that if you’re running out of money.

If you’re single, simply take away the spousal benefit for Social Security and you have a baseline of $3,000 a month to work with. Will that get you a new Mercedes Benz? Nope. Will it put food on the table? Yes sir, it will.

Now, it’s highly unlikely you’ll spend down your entire retirement portfolio but just say you did. You have equity in your home no? Of course you do! That’s why I’m so adamant on considering how reverse mortgages could help your retirement. You can see the interview I did with Don Graves the other day here.

Maybe a reverse mortgage isn’t for you. That’s fine. I’m just showing you there are plenty of options to make ends meet in retirement without having 7 figures of investments.

If this were not true, how on the Good Lord’s green earth (more CO2 = more green btw), would so many people continually report they are happy in retirement? Something stinks in Denmark with all the fear being batted around about retirement inadequacy. Where. Is.The. Evidence???

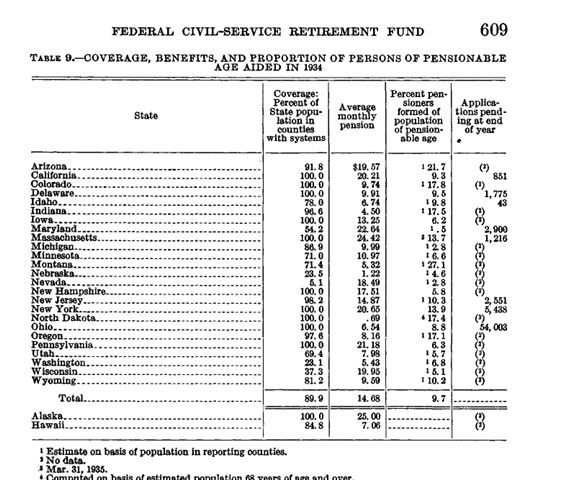

Side note. You know how the naysayers all say “it was better back in the old days when everyone had a pension”? Yeah, check this out.